www.tax.ny.gov basic star exemption

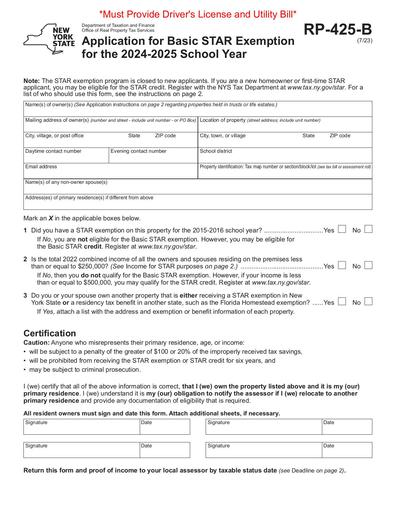

Resident homeowners applying for STAR for the first time are not affected by this years registration procedure. The benefit is estimated to be a 293 tax reduction.

Nyc Property Tax Bills How To Find And Read Them Yoreevo

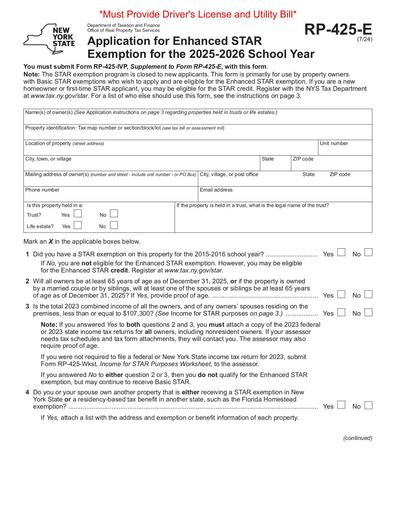

Enhanced STAR exemptions are calculated the same way except the base amount for the Enhanced STAR exemption in the 2021-2022 school year is 70700 rather than 30000 for Basic STAR.

. Available if you own and occupy a residential property with federally adjusted gross income under 500000. Data are shown for the number and amount of basic and enhanced STAR exemptions and reimbursements by county for each levy year. The following security code is necessary to prevent unauthorized use of this web site.

The income limit applies to the combined incomes of only the owners and owners spouses who reside at the property. You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply. The dates pertain to assessing units that publish their final assessment rolls on July 1.

12 rows Application for School Tax Relief STAR Exemption. To apply to STAR a new applicant must. If you are using a screen reading program select listen to have the number announced.

If you are already receiving the STAR credit you do not. Star School Tax Relief Basic Exemption. Applicants will now register with New York State by visiting wwwtaxnygov or by calling 518 457-2036.

HARRIS-PERO BOTELHO PLLC. New applicants must apply to the state for the credit. Basic and Enhanced STAR Exemption New STAR applicants will receive a check from New York State instead of a reduction on the school.

Enrollment in automatic income verification is mandatory. In 2016 STAR was changed by state law from a property tax exemption to an income tax credit. If you have further questions about STAR contact your New York State Senator or call the STAR helpline at 518-457-2036 from.

STAR helps lower property taxes for eligible homeowners who live in New York State school districts. The formula below is used to calculate Basic STAR exemptions. A senior who may be eligible for the Enhanced STAR credit.

In those five cities the exemption is applied partly to city. The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. 250000 or less for the STAR exemption.

20222023 STAR exemption amounts STAR exemption amounts and maximum savings now available online. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live. Applicants will now register with New York State by visiting wwwtaxnygov or by calling 518 457-2036.

The dollar value of the credit will. Please keep in mind that those homeowners that currently receive the Basic STAR exemption and do not wish to switch to the credit program if they believe they qualify for Enhanced STAR they must still apply for the for Enhanced STAR exemption through the Nassau County Department of Assessment utilizing the following form. If you are eligible and enrolled in the STAR program youll receive your benefit each year in one of two ways.

Owners who were receiving the benefit as of March 15 2015 can continue to receive it. If you are eligible you will receive the credit in the form of a check. The STAR program continues to provide much-needed property tax relief to New York States homeowners.

The deadline to file for all exemptions is March 1. The total income of all owners and resident spouses or registered domestic partners cannot. Form RP-425-B821 Application for Basic STAR Exemption for the 2020-2021 School Year Revised 821 Created Date.

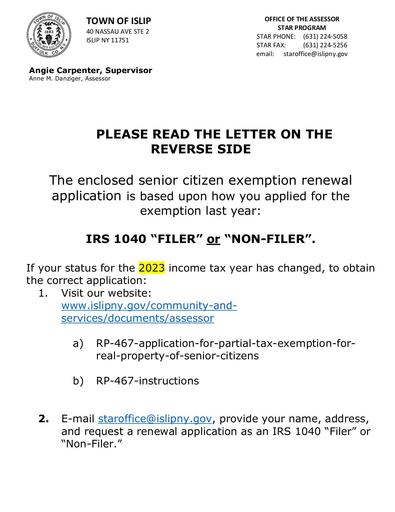

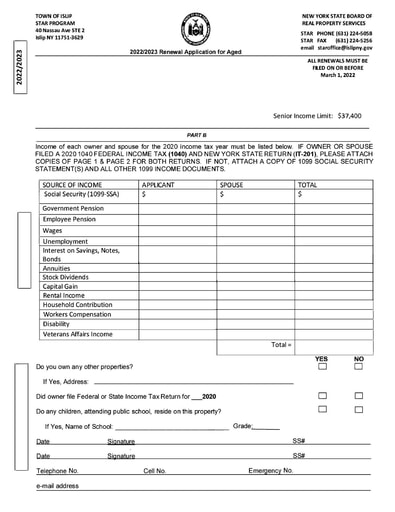

Accordance with Section 467 of the New York State Real Property Tax Law. You currently receive Basic STAR and would like to apply for Enhanced STAR. More than 17 million New York homeowners have registered for their Basic STAR property tax exemptions.

All primary-residence homeowners are eligible for the Basic STAR exemption regardless of age or income. 500000 or less for the STAR credit. The STAR benefit applies only to school district taxes.

All home owners regardless of age or income may apply for the Basic STAR Exemption. An existing homeowner who is not receiving the STAR exemption or credit. STAR School TAx Relief Basic STAR no renewal required NO Age requirements Income limit-less than 500000 If you own the property and it is your.

HOME IMPROVEMENT PROPERTY TAX EXEMPTION STAR is the New York State School Tax Relief program that provides an exemption from school property taxes for owner-occupied primary residences. For an application call 571-1500 or visit. If you are a Basic STAR exemption recipient who turns 65 and meets the eligibility requirements you should apply to your.

New applicants who qualify for STAR will register with New York State instead of applying with their assessor. This dataset is a compilation of annual data for each school year. The Department of Taxation and Finances Office of Real Property Tax Services maintains data on the New York State STAR program.

STAR materials are available in Spanish Chinese Korean Italian Russian and Haitian Creole. Below you can find a guide to frequently asked questions about the program. It doesnt apply to county town or city taxes except in the cities of New York Buffalo Rochester Yonkers and Syracuse.

Enter the security code displayed below and then select Continue. A manufactured homeowner who received a letter that you must register for the STAR credit to continue receiving a STAR benefit Form RP-425-RMM. See Surviving spouse eligibility.

If you are approved for E-STAR the New York State Department of Taxation and Finance will use the Social Security numbers you provide on this form to automatically verify your income eligibility in subsequent years. Beginning with 2016 law requires any new applications be filed with New York State on line at wwwTaxNYgov or via phone at 518-457-2036. To be eligible for Basic STAR your income must be 250000 or less.

To learn more about STAR registration visit the Tax Department at wwwtaxnygov or call. Based on the first 74900 of the full value of a home for the 2022-2023 school year. Basic STAR is for homeowners whose total household income is 500000 or less.

By submitting this application you grant your permission. The School Tax Relief STAR Program FAQ Updated 2021 The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners. Use Form RP-425 Application for School Tax Relief STAR Exemption available on the Tax Departments website at taxnygov or contact the Nassau County Assessors Office at 516.

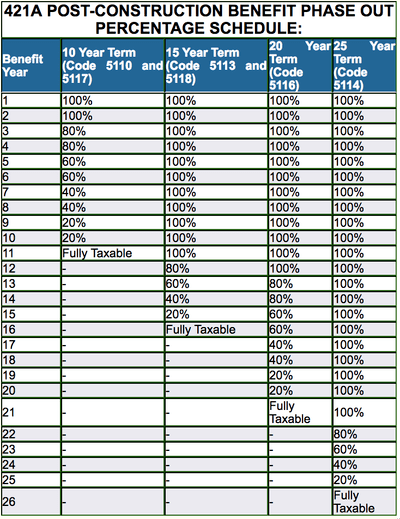

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc Residential Property Tax Guide For Class 1 Properties

Receiver Of Taxes Town Of Oyster Bay

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The Enhanced Star Property Tax Exemption In Nyc Nyc Condo Buying A Condo Property Tax

Condo Closing Timeline Nyc Hauseit Nyc Condo Buying A Condo

Tax Rebate Program 480 A Forest Tax Law Nys Dept Of Environmental Conservation Environmental Conservation Law Tax

The School Tax Relief Star Program Faq Ny State Senate

Tax Rebate Program 480 A Forest Tax Law Nys Dept Of Environmental Conservation Environmental Conservation Law Tax